Are you looking to refinance your mortgage and create some cash? Cash-out refinancing is a refinancing option that allows the borrower to receive money by taking out a larger mortgage on their property than their current mortgage. The monetary difference between the two mortgages is converted into cash and made available to the borrower. If you’ve been asking yourself whether a cash-out refi or a home equity loan is a better option, read on to inform your decision-making process.

How Could a Cash-Out Refinance Help You? -Receive cash for major expenses. -Consolidate your debt. -Reinvest the cash you get back into your home. -Shorten your loan term and/or get a lower rate. -How Much Can I Cash-Out Refinance? -How much you can refinance depends on a few things. One of the most significant components of determining the amount of a cash-out refinance is how much of your home you currently own.

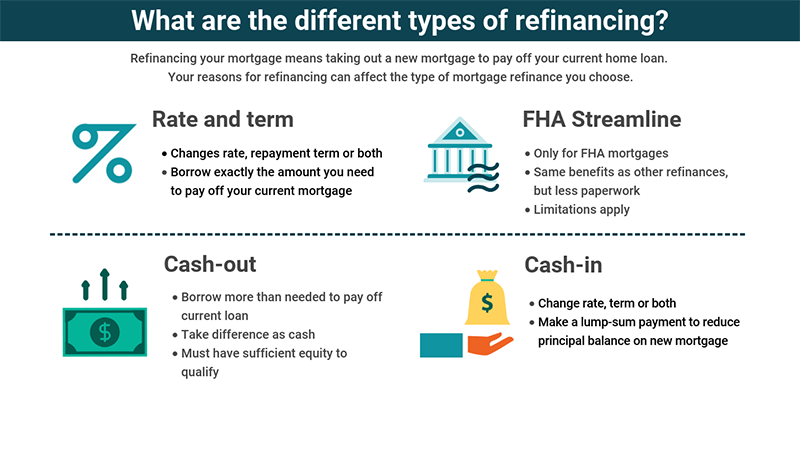

What is the difference between refinance and a cash-out refinance?

A simple refinance doesn’t extract any of the equity from your home. You get lower interest rates and a lower mortgage payment, and the term of your loan may be extended to give you a little more time to pay it off. Yet you won’t get a check or any additional money to conduct repairs or to make improvements.

A cash-out refinance refinances and pays off the original mortgage, but gives you access to some of your equity. This puts cash in your hand which you can then use for a variety of purposes. A cash-out refinance essentially combines a refinance with a home equity loan to give you some financial flexibility.